Crypto-to-Crypto Swaps Explained

- What is Crypto Swapping?

- Crypto Swap vs. Traditional Trading

- How Crypto Swaps Work?

- Benefits of Using Kauri Web3 Wallet for Crypto Swaps

- Step-by-Step Guide on How to Swap Crypto in Kauri Web3 Wallet:

- Decentralized vs. Centralized Exchanges

- Decentralized Exchanges (DEXs)

- Pros:

- Cons:

- Examples of Popular DEXs:

- Centralized Exchanges (CEXs)

- Pros:

- Cons:

- Examples of Popular CEXs:

- Conclusion

Traditional methods of trading, which often involved converting cryptocurrencies into fiat currencies before purchasing others, were not only cumbersome but also costly due to high fees and time delays. This process has been revolutionized by the advent of crypto-to-crypto swaps, a method that allows direct exchange of one cryptocurrency for another without the need to convert to fiat.

Crypto-to-crypto swaps have streamlined the trading process, offering a quicker, cheaper, and more efficient means of managing digital assets. This evolution is particularly beneficial in a market known for its rapid price movements and the need for agility. Through platforms offering these swaps, traders can respond swiftly to market changes and opportunities without the burden of multiple transaction layers and associated costs.

What is Crypto Swapping?

Crypto swapping is the process of exchanging one cryptocurrency for another directly, without the intermediate step of converting to fiat currency. This mechanism is facilitated by various platforms that allow users to trade one type of crypto asset for another based on real-time exchange rates. The essence of crypto swapping lies in its ability to bypass traditional banking systems and fiat currencies, streamlining transactions and reducing reliance on conventional financial infrastructures.

Crypto Swap vs. Traditional Trading

The distinction between crypto swapping and traditional trading is significant, primarily in terms of process efficiency and cost:

- Process Efficiency: Traditional trading often requires a two-step process where a cryptocurrency is first sold for fiat currency, and then the fiat is used to buy another cryptocurrency. This method is not only time-consuming but also exposes traders to market volatility, potentially leading to financial losses between transactions. Crypto swapping, on the other hand, is instantaneous. As soon as a match is found, assets are exchanged directly between users' wallets, reflecting immediately.

- Lower Fees: Traditional trading can incur high fees as it typically involves exchanges or brokers who charge for each transaction. There are fees for selling the cryptocurrency and additional fees for buying the new one. Crypto swaps usually have lower fees as they eliminate the need for fiat intermediaries and leverage automated, peer-to-peer transactions facilitated by smart contracts or similar technologies.

- Time Efficiency: Swaps are conducted almost instantaneously on the blockchain, allowing traders to take advantage of market conditions without the delays associated with traditional exchanges. This speed is crucial in a market as volatile as the crypto market, where prices can change dramatically in a matter of minutes.

How Crypto Swaps Work?

Crypto swaps are facilitated by sophisticated technologies that operate primarily on blockchain networks. Here's a closer look at how these transactions are typically conducted:

- Smart Contracts: At the core of crypto swaps, especially on decentralized platforms, are smart contracts. These are self-executing contracts with the terms of the agreement between buyer and seller directly written into lines of code. The smart contract automatically executes the transaction once predefined conditions are met, ensuring that the swap is completed fairly and without the need for an intermediary.

- Liquidity Pools: Many decentralized exchanges utilize liquidity pools which are essentially big reserves of different tokens that users can swap instantly. Users who provide liquidity to these pools are often rewarded with transaction fees or other incentives.

- Atomic Swaps: Some advanced platforms allow for atomic swaps, which enable the exchange of one cryptocurrency for another without the need for a trusted third party. These swaps are called "atomic" because they ensure that either the trade is successfully completed, or it is cancelled altogether, hence there is no intermediate state where one party could potentially be at a disadvantage.

Places to exchange cryptocurrencies:

- Within Wallets: Many modern crypto wallets, like the Kauri Web3 Wallet, offer built-in swap functionalities. These wallets provide a user-friendly interface where users can easily select their desired cryptocurrencies and execute swaps directly within the app. This not only enhances security by keeping control of the keys with the user but also simplifies the swapping process.

- Decentralized Exchanges (DEXs): Decentralized exchanges are built on blockchain technology and enable direct peer-to-peer transactions without the need for a central authority. Platforms like Uniswap, SushiSwap, and PancakeSwap are popular examples of DEXs that use liquidity pools to facilitate swaps. These platforms are favored for their enhanced security and privacy, as they do not require users to relinquish control of their keys to a third party.

- Centralized Exchanges (CEXs): Unlike DEXs, centralized exchanges are managed by a company that facilitates crypto trading. Exchanges like Coinbase and Binance offer crypto swapping services where users can trade one digital asset for another using the exchange’s internal systems. While these platforms generally offer higher liquidity and faster transaction speeds, they require users to trust the exchange with their funds.

Each of these venues has its own set of advantages and considerations, from the security and control offered by wallets and DEXs to the liquidity and speed of CEXs. Choosing the right platform for crypto swaps depends on the user’s specific needs, such as the level of security desired, the types of tokens they wish to swap, and their personal risk tolerance.

Benefits of Using Kauri Web3 Wallet for Crypto Swaps

Kauri Web3 Wallet offers a seamless and secure environment for crypto-to-crypto swaps. Here are some of the primary benefits:

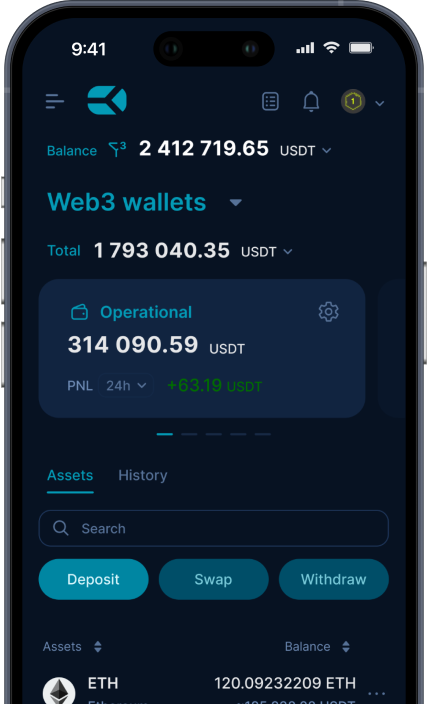

- User-Friendly Interface: Designed with both beginners and experienced users in mind, the Kauri Web3 Wallet provides an intuitive interface that simplifies the swapping process. Users can easily navigate through the wallet to perform swaps without extensive technical knowledge.

- Direct Control Over Assets: As a non-custodial wallet, Kauri Web3 Wallet allows users to retain full control over their private keys and, consequently, their crypto assets. This direct control not only enhances security but also ensures that users can manage their assets without interference from third parties.

- Support for Multiple Cryptocurrencies: The wallet supports a wide range of digital assets, enabling users to swap between different cryptocurrencies directly within the app. This versatility is crucial for users looking to diversify their portfolios or react quickly to market changes.

- Reduced Fees: Swapping within the Kauri Web3 Wallet generally incurs lower fees compared to traditional exchanges. The wallet structures its fees to be transparent and competitive, which can significantly reduce the cost of frequent trading.

Step-by-Step Guide on How to Swap Crypto in Kauri Web3 Wallet:

Here's a formatted table summarizing the fee structure for the Kauri Web3 Wallet:

|

WEB3 Wallet Open |

Free |

|

Deposit |

Only Blockchain Fee |

|

Withdrawal |

Only Blockchain Fee |

|

Currency Exchange |

|

|

Crypto > Crypto |

0.2% + Only Blockchain Fee |

|

Crypto > Fiat |

0.5% + Only Blockchain Fee |

|

Fiat > Crypto |

0.5% + Only Blockchain Fee |

|

Other Fees |

|

|

Fix rate |

from 5 till 30 min 1% |

|

Sell blockchain fee |

produce own gas 2.5% |

Here's how to perform a crypto-to-crypto swap directly within the Kauri Web3 Wallet:

- Access Your Wallet: Open the Kauri Web3 Wallet on your device. If you haven’t already done so, you'll need to set up your wallet by following the initial registration and security procedures.

- Navigate to the Swap Interface: Within the wallet, locate the ‘Swap’ feature. This is typically found in the main menu or directly on the dashboard.

- Select Your Currencies: Choose the cryptocurrency you wish to swap from the list of available assets, and then select the cryptocurrency you want to receive. Ensure that you have sufficient funds in the wallet to complete the swap.

- Enter Swap Amount: Input the amount of cryptocurrency you want to swap. The wallet will automatically calculate the equivalent amount of the target cryptocurrency based on the current market rate.

- Review Swap Details: Before executing the swap, review all the details, including the exchange rate and fees. Some wallets provide a preview of the transaction for confirmation.

- Confirm the Transaction: Once you’re satisfied with the details, confirm the transaction. The wallet will execute the swap using smart contracts to ensure a secure and direct exchange between the two currencies.

- Receive Confirmation: After the swap is processed, you should receive confirmation in your wallet. The new cryptocurrency amount will reflect in your balance.

- Check Transaction History: If you wish to verify the transaction details, you can check your wallet’s transaction history where all swaps and transfers are recorded.

By following these steps, you can efficiently manage your cryptocurrency portfolio directly within the Kauri Web3 Wallet, taking advantage of its robust features to enhance your trading experience.

Decentralized vs. Centralized Exchanges

When it comes to crypto-to-crypto swaps, traders can choose between decentralized exchanges (DEXs) and centralized exchanges (CEXs). Each type offers distinct advantages and challenges, making the choice dependent on the user's specific needs and preferences.

Decentralized Exchanges (DEXs)

Pros:

- Anonymity: DEXs do not typically require users to undergo identity verification, offering greater privacy.

- Security: Without a central point of control, DEXs are less vulnerable to hacking attacks on the platform itself. Users maintain control of their private keys, reducing the risk of losing assets to exchange breaches.

- Direct Transactions: Trades are peer-to-peer, without the need for an intermediary, which can reduce transaction fees and avoid potential censorship from central authorities.

Cons:

- User Experience: The interface and user experience on DEXs can be less intuitive than on centralized platforms. This might deter less experienced users.

- Liquidity: Smaller and newer DEXs may suffer from low liquidity, leading to higher price volatility and difficulty in executing large orders.

- Speed: Depending on the network and its congestion, transaction speed can be slower compared to CEXs, particularly during high volume periods.

Examples of Popular DEXs:

- Uniswap: Known for its user-friendly interface and vast range of ERC-20 token pairs.

- SushiSwap: Similar to Uniswap but with added community governance features and a cross-chain ecosystem.

- PancakeSwap: Operates on the Binance Smart Chain, known for lower transaction fees compared to Ethereum-based DEXs.

Centralized Exchanges (CEXs)

Pros:

- Ease of Use: CEXs generally offer a more user-friendly interface and additional services like customer support, making them accessible to beginners.

- High Liquidity: Centralized platforms often have higher trading volumes and liquidity, facilitating quicker trades and better prices, especially for large volume transactions.

- Advanced Features: Many CEXs provide additional trading features such as futures, options, and margin trading.

Cons:

- Security Risks: Centralized platforms are more attractive targets for hackers since they hold a large amount of funds in a single location.

- Privacy Concerns: CEXs require users to complete KYC (Know Your Customer) procedures, which involves sharing personal information.

- Custodial Risks: Users typically have to deposit funds into their exchange accounts, meaning they do not control the private keys for those assets while they are held on the exchange.

Examples of Popular CEXs:

- Coinbase: Renowned for its easy interface and strong regulatory compliance, ideal for beginners.

- Binance: Offers a wide range of cryptocurrencies and trading pairs with some of the lowest fees in the industry.

- Kraken: Known for its security features and comprehensive range of available cryptocurrencies and fiat pairs.

Conclusion

Crypto-to-crypto swaps streamline the trading process by offering a faster, more cost-effective way to manage and diversify digital assets. By facilitating direct exchanges without the need for fiat conversion, these swaps minimize fees and maximize efficiency, making them an essential tool for modern crypto traders. Kauri Finance provides robust resources through the Kauri Academy to help traders of all levels harness the full potential of crypto swaps.